Sweetgreen: A Focus On Healthy Food Should Benefit The Stock (NYSE:SG)

Scott Olson/Getty Images News

Investment thesis

Sweetgreen, Inc. (NYSE:SG) operates fast-casual restaurants in the U.S. It aims to serve healthy foods prepared from locally sourced, seasonal, and organic ingredients. With increasing health-related illnesses, there is growing awareness about having a healthy diet, and thus the healthy food market has huge potential. However, although the market has huge potential, Sweetgreen is not operationally profitable. It incurred an operating loss of -$134.4 million for fiscal 2021, as against an operating loss of -$141.6 million for fiscal 2020. The company went public in November 2021.

Moreover, the restaurant industry is highly competitive, with many local, national, and regional chains. Thus, until the time the company can deliver consistent operating profits, it’s better to wait and watch the stock.

Business

As of December 26, 2021, Sweetgreen owned and operated 150 restaurants. It has a presence in 13 states and Washington, D.C. The company has a steady restaurant opening rate. It opened 31 restaurants in FY2021. In 2022, the management plans to open 35 new restaurants. The company has an ambition of operating 1,000 restaurants by the end of the decade. Thus, the management has good growth plans and a steady record to show that they can expand.

Sweetgreen

The company has a 5-channel model to order food. Customers can place order through mobile app or website and eventually collect the order from the chosen Sweetgreen location at the time of their convenience.

Customers can also order their custom Sweetgreen order and get delivery at an outpost station at their location during a specific pre-decided time. This facility is especially attractive to working individuals who wish to have healthier food options than what local restaurants and QSR chains offer. As of the end of fiscal year 2021, the company had 481 live Outpost locations.

The company has its own delivery channel called Native Delivery channel, wherein it provides better delivery radii along with several offers. It also operates through a Marketplace Channel which often serves as an effective means to reach new digital customers who have not used their native mobile app or website before. Apart from this, the company also has in-store buying option.

Greater share of digital is a positive sign for future stock performance

For fiscal year 2021, 46.1% of the revenue was from Sweetgreen’s own digital channels. Including orders placed on the Marketplace Channel, this digital share increases to 67.4% of fiscal year 2021 revenue. Having a greater digital revenue share shows that Sweetgreen is utilizing technology well, which will help the company grow its customer base without opening more restaurants. The average order value (which is the dollar value of an order exclusive of taxes and any fees paid by the customer) for orders placed on its owned digital channels is also significantly higher than non-digital orders placed through In-Store Channel.

Risks

Sweetgreen is not making a profit. The restaurant industry is highly competitive, with many of the company’s competitors also ramping up their digital presence after the start of the pandemic. The company also faces a threat from food delivery marketplaces like Uber Eats (UBER) and Grubhub.

The company has incurred significant losses since inception and anticipates that operating expenses and capital expenditures will increase substantially in the foreseeable future. The main reason for this will be expansion plans of the company.

As Sweetgreen’s Native Delivery, Outpost, and Marketplace Channels require the payment of third-party fees to fulfill deliveries, sales through these channels have historically negatively impacted the margins. However, over time, management expects that the margins will improve on Native Delivery, Outpost, and Marketplace Channels as they scale these channels. This may be achieved by negotiating lower third-party delivery fees, and on Outpost via similar negotiation and/or more efficient delivery from couriers. However, one needs to wait and watch how this materializes.

Financials are not very encouraging

For the fiscal 2021, the company had revenue of $339.9 million as against $220.6 million in fiscal 2020. Losses from operations for FY2021 stood at -$134.4 million against -$141.6 million for FY2020. So, the company’s revenue grew, and its losses narrowed in 2021.

At the same time, same-store sales change was positive in 2021.

|

2021 |

2020 |

2019 |

|

|

Average Unit Volume (as adjusted) ($) |

$2,623 |

$2,194 |

$2,967 |

|

Same store sales change (as adjusted) (%) |

25% |

-26% |

15% |

Data source: Sweetgreen.

In the first quarter, the company reported same-store sales change of 35%.

Despite encouraging signs, Sweetgreen posted net loss of -$49.2 million in the first quarter. At the same time, industry conditions are not very supportive for margin growth. A January 2022 report by the National Restaurant Association noted:

More than half of restaurant operators said it would be a year or more before business conditions return to normal. Food, labor, and occupancy costs are expected to remain elevated, and continue to impact restaurant profit margins in 2022.

SG Valuation

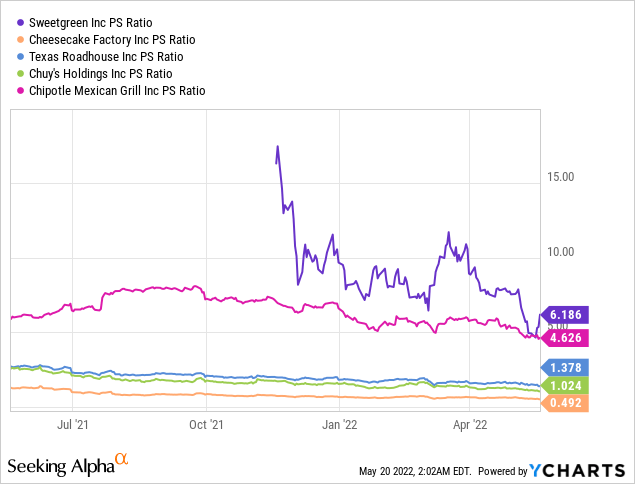

Based on relative valuation, Sweetgreen stock, with a price-to-sales ratio of 5.3, looks costly relative to its peers Cheesecake Factory (CAKE), Texas Roadhouse (TXRH), Chuy’s Holdings (CHUY), and Chipotle (CMG).

Coupled with the fact that Sweetgreen is not profitable yet, the P/S ratio looks quite high.

Conclusion

Even with an obvious growth potential in health food industry and the company’s growth plan of having more than 1,000 restaurants by the end of the decade, it still faces many challenges that it must overcome. Firstly, it must become operationally profitable. The elevated food, labor, and occupancy cost as per the National Restaurant Association’s report may add additional pressure on the company’s financials.

Moreover, restaurant business is highly competitive with the competition adapting fast and improving themselves in the digital ordering space where Sweetgreen expects to find its future revenue growth. According to a report by BCG, delivery’s market share rose from 7% in 2019 to about 20% in 2020. The report further states that across the industry, digital ordering represents 28% of all orders post-pandemic compared with 10% before the pandemic, with most brands showing increases. So, Sweetgreen’s competitors too are utilizing technology to boost growth.

The stock is also relatively costly based on the P/S multiple. Thus, even though the industry is attractive, Sweetgreen stock needs to be monitored till the company shows signs of consistent profitability.